on nostr here)

- 49 Posts

- 361 Comments

11·10 hours ago

11·10 hours agoOne option is to ask open source language models to make lessons/quizzes/etc for you

4·10 hours ago

4·10 hours agoNo, you may have to re-login every time you connect, but once you connect, your MAC would be stable for that session.

deleted by creator

How has the purchasing power of your USD held up over the last 5 years? Because BTC has done pretty damned well. And your BTC still represents the same portion of supply as it always did. BTC is already more widely used and more stable than most national currencies. Unlike fiat currency, it isn’t designed to lose value over time to inflation of the supply.

Here’s how much USD, Gold, and BTC it takes to buy a house in the US over time.

Yes absolutely, because any time the government can increase surveillance and control, they will. The Pirate Party is one of the few political forces in the EU fighting hard against this. Central Bank Digital Currencies will be the biggest threat to individual liberty and privacy we see in our lifetimes. In a time of global instability, these threats to our freedoms continue to compound from all over the political spectrum. People are more willing to accept some loss in freedom in the promise it will protect them from the “other side” gaining too much power or from worsening economic or other environmental conditions.

Bitcoin is a solution for those who want privacy, money, and autonomy to work hand in hand. Bitcoin offers much more robust privacy than a bank account and the degree of privacy it offers continues to improve. It’s not controlled by a central bank, entity, or board of directors who can mess with the supply or have any kind of special access to your financial information. You don’t need six forms of ID to use it, in fact, you don’t even need one! It’s truly autonomous money that separates the role of the state from the role of money.

With Bitcoin, I can send money to anybody anywhere on planet earth with a cell phone and a halfway reliable internet connection in under a second for pennies in fees (using Bitcoin lightning). And I can send that money to anybody even if they have an unstable banking system, no banking system at all (billions of people), or their banking system excludes them due to their gender, sexuality, or status as a political dissident. Venmo can’t do that, Paypal can’t do that, my bank can’t do that, Taler can’t do that. It has a clear fiscal policy of a 21 million coin cap. It has faced attacks and attempted bans from nation states and world powers, yet it has reliably performed this function of sending money around for 15 years without a single hour of downtime, without a single hack, without a single bank holiday or failure or any kind. It has a market cap bigger than Sweden’s GDP. It is more widely adopted than most national currencies. It can’t be controlled, debased, or inflated by any corrupt central bank. It actually has use and value. You may not use it, but that doesn’t mean other people don’t get immense use out of it.

Monero is king when it comes to privacy coins though. So from a privacy perspective, that’s worth looking into as well. Long-term I think Bitcoin will eat Monero for lunch since it can easily adopt the privacy technologies Monero has and the Bitcoin community is very pro privacy. Monero also lacks an L2 like lightning which means transactions are slower and more expensive and eventually fees will get ridiculous if adoption reaches parity with Bitcoin. Depending on your use case, that may or may not matter.

Project 2025 wants to:

- Outlaw pornography

- Outlaw abortion

- Outlaw homosexuality

- Eliminate all major checks on presidential power. Say goodbye to the system of checks and balances

- Replace many federal workers with those who are loyal only to the president

www.defeatproject2025.org breaks it down by topic, also highly suggest John Oliver’s segment on it

Project 2025 wants to:

- Outlaw pornography

- Outlaw abortion

- Outlaw homosexuality

- Eliminate all major checks on presidential power. Say goodbye to the system of checks and balances

- Replace many federal workers with those who are loyal only to the president

www.defeatproject2025.org breaks it down by topic, also highly suggest John Oliver’s segment on it

92·3 days ago

92·3 days agoGood to see Julian free, he paid a high price for giving people access to relevant, important information about the corruption of their governments.

42·4 days ago

42·4 days agoIt’s not the right of the business, it’s the right of US citizens to consume media and information from any source they please. The Govt has no right to say “You can’t read that newspaper” or “You can’t listen to that speaker”, so they have no right to say “You can’t get information through this app”. The first amendment isn’t just about the right to speak, it’s also about the right to listen and research especially the stuff the government doesn’t want you to know about.

1·4 days ago

1·4 days agoBecause section 702 evidence isn’t showing up in court in other cases. That’s why they have an opportunity to challenge it here. They aren’t defending the nazi, they are defending all of us from being taken to court with evidence obtained without a warrant.

Separate apps more focused on privacy will always be better than RCS/SMS/whatever the mainstream option is.

92·5 days ago

92·5 days agoIt’s a shame the US govt has to try to do unconstitutional things. And that we have to keep fighting them back to preserve our basic liberties and freedoms. It’s a blessing the ACLU does it for us.

341·5 days ago

341·5 days agoAll of them. Make “banning advertising” an election platform, I’ll vote for you. Ban billboards and other forms of commercial advertising everywhere. Advertising works, nobody denies that. If you see enough ads, on average, your mind will be changed. By allowing advertising to exist, we are sanctioning widespread mind control. It sounds crazy when you say it that way, but it’s true. Advertising does not benefit the average person, it makes them buy stuff they have no native desire for. Advertising only benefits advertising agencies and their clients.

Let word-of-mouth and genuine desire for a good or service drive purchases of that good or service, not advertising, and you’ll end up with a more efficient economy where our consumer choices better invest in our shared prosperity and future.

1·8 days ago

1·8 days agoInstead of fixing those issues, most other coins are just pump and dump schemes for a quick buck.

Oh agree totally on this one.

Bitcoin and many other currencies have way too many and large fluctuations in value for daily use.

If you are using it to send money from point A to point B, you can cash it out at the same price you put it in at, so fluctuation doesn’t matter much. You’re probably saving on bank fees and exchange risk enhanced by slow international settlement. Exchange risk is always a thing with any currency. It’s gotten more stable over time and I imagine that trend will continue. Other currencies are also unstable, how has the purchasing power of the USD held up over the last 5 years? That’s not to mention the billions of people not fortunate enough to live in a currency environment which is dominated by the dollar. Ask any Argentenian or Turkish person how stable their currency is compared to Bitcoin. Best case scenario, your dollar slowly loses value over time due to supply inflation. Whether or not you find it useful, more and more people find it useful every year, the transaction volume has increased reliably for 15 years. Nobody’s making them use it. On the contrary, there are often hurdles educational, regulatory, and technological to using it, but they still do. Maybe on year 16 though people will finally realize it’s useless and stop using it.

Bitcoin specifically is not practical for transactions in general due to cost and block size limits. Yes, lightning exists, but maybe your technology is shit if it needs a second overlay network to function.

Maybe TCP/IP is shit if we need other protocols build on top of it like SMTP. Maybe ethernet is shit if we have to design a whole nother protocol (TCP) just to make sure packets actually arive in the proper order. No. This is a weak argument. Fedwire, the system for settlement between US banks, has a equivalent transaction speed to Bitcoin’s base layer. Banks don’t seem to have any problem with that speed. And ten minutes is pretty dang fast to send a million dollar transaction across the globe (on main chain) or under a second (on lightning). Meanwhile, the US dollar doesn’t have a built-in transfer mechanism, and the mechanisms available can be quite frustrating or expensive to work with, ask anybody whose ever had to send an international bank wire or deal with the frequent buyer return fraud on platforms like eBay. I’d sell an iPhone to somebody in (insert fraud prone country here) no problem in BTC. With PayPal? No effing way,

4·9 days ago

4·9 days agoI need something like a Spotify subscription for open source to assuage my guilt of the great value I extract for my personal use of open source.

I would love to see something like this, where I can contribute to an open source project while also contributing to all their dependencies. Maybe such a thing exists and I just haven’t heard of it yet.

3·9 days ago

3·9 days agoLook, I love privacy and I agree Bitcoin needs more of it. Many developers/OSS projects would have trouble using XMR, the off-ramps are few and far between. Bitcoin’s privacy continues to get better and you can achieve significant degrees of anonymity with techniques like coinjoin etc. Lightning is pretty opaque, all the data on chain is who you opened your lightning channel with, not ANY of the transaction data between you and any other party (and remember, a single lightning channel can route payments to any other lightning user). And you can run a lightning node/wallet on an android. Long-term Bitcoin could absorb Monero’s entire market cap by simply copying its privacy features into a future protocol upgrade, which I hope it does as it has with experimental protocol changes first tried on other blockchains. And the Bitcoin community seems very pro-privacy.

Monero has no functional L2 and only has “low fees” because it doesn’t have the tx volume to get higher fees. Bitcoin has had a functional L2 for 5+ years now. Lightning fees are usually a penny or two per transaction, if sending large amounts, an on-chain tx is still only like $1.50 most of the time. Settlement on Monero takes minutes instead of less than a second on lightning, not that it matters for this particular use case. It doesn’t have nearly the network of developers, users, or other people in the ecosystem backing it. Monero also has larger variable-sized blocks. Larger block sizes = more hardware requirements to run a node = more centralization. Bitcoin already had that debate and every other debate and chose decentralization at every turn. Monero chose bigger blocks just like Bitcoin cash did. Bigger block is not a scalable solution while remaining decentralized. No thanks. All of humanity’s transactions shouldn’t be stored on the blockchain for eternity, that is incredibly inefficient and needless. Nano has similar problems with design, no way to compensate those who run the infrastructure for the network, and pretty much nobody using it, and probably a massive pre-mine.

There are some fundamental problems to blockchain, digital currency, or decentralized ledgers. If you want a decentralized ledger, space is your biggest limitation. If you want more space, you get more centralization. Every other coin chose more space for “lower fees” or “faster transactions”, Bitcoin chose decentralization at every possible turn (at the cost of having less space) and will continue to do so. For me, that is bar none the most important factor. And now it also has “fast transactions” and “low fees” thanks to L2s.

5·9 days ago

5·9 days agoLove hearing from devs that donations are coming into their projects, thank you for sharing that! Contributing time and expertise is just as important thank you for your contributions 🫡🫡🫡

13·9 days ago

13·9 days agoOpenShot went terribly for me. Cool idea but did not work. Ate hours and hours of editing by failing to export. I tried everything, even opening Github issues to figure out where the problem was. Systematically re-cut and edited and moved every clip. Still couldn’t get it to export even though everything worked flawlessly in editing and previewing. Tried switching to latest, alpha, whatever, none of them could export. Absolute nightmare. Do not recommend. Eventually had to re-do everything in kdenlive.

4·9 days ago

4·9 days agoQubes is so cool. The most under-rated Linux distro imo. Not my daily driver but a very cool concept.

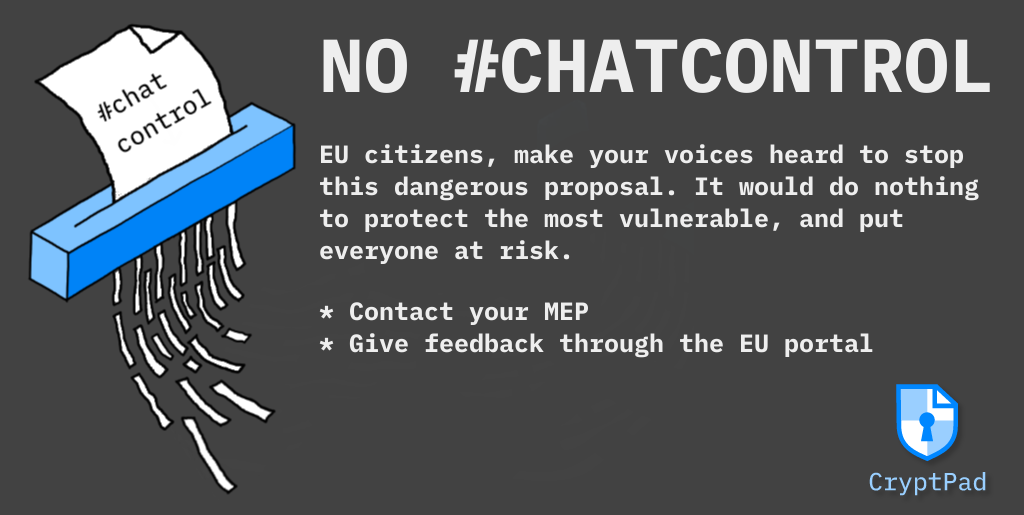

Anonymity is also crucial for democracy. Anonymity is required for sources to leak material to the press about corruption and malfeasance. Anonymity is required for people to speak honestly and freely. When the government turns against its critics, anonymity is required for those critics to speak safely.

You can still investigate crimes without eliminating the right to privacy or anonymity. It requires talking to people, finding witnesses, and doing good old detective work. The simple fact of the matter is that police have more tools today to fight crime than they ever have in human history. All of our communications, our phones and CCTV tracking our every move, etc yet crime still happens. Most crimes go uninvestigated and unprosecuted despite this wealth of invasive access. We were told if we traded our privacy and liberties we would be safe from crime, but the truth is that criminals will still crime and rich and powerful people will still get away with crime. The only difference now is that we lost our freedom and privacy along the way. And every day, we are told we need to give up even more freedom and then really, truly, the system will find those bad guys and eliminate them. Except the bad guys are often the ones who run and benefit most from the system. And they’ve gone so far to convince much of the population that doing things privately (like making transactions) is in and of itself a sign of criminal behavior or intent.

People 100 years ago in the US would scoff at the idea that the government would be able to monitor every financial transaction they made or read all their mail. Yet all day I see people in these comments saying how this is normal, needed even, for society to operate well.